International travel is the most rewarding experience, and travel rewards cards can be a great advantage. But, choosing from the seemingly endless options can be a bit overwhelming.

The biggest thing to keep in mind when it comes to choosing a rewards card is deciding what you want to use it for. Every card has a primary benefit and knowing what you are most likely to use the card for will help you maximize your reward points.

For example, knowing that I want to travel internationally I looked for an airline rewards card with a lot of international destinations. You might have a completely different need based on your own travel trends. Below I have outlined a few of the best travel rewards cards with their primary benefits and drawbacks.

1. American Airlines Citi Advantage Card

The AAvantage Platinum Citi Card is the card that I primarily use for my travel rewards simply because it allows me to accrue miles with an airline that has a lot of international destinations.

American Airlines also partners with British Airways which opens it up even further. The card offers 2 AAdvantage miles for every dollar spent and offers a generous sign-up bonus for new customers.

Travelers can earn 30,000 bonus miles after making $1,000 in purchases within the first 3 months of account opening. Enjoy preferred boarding on American Airlines flights as well.

The biggest downside to the card is the fact that points are not transferable. I can only use my points with AA or one of their affiliates.

2. Chase Sapphire Preferred Card

You will find an extremely well-rounded card with the Chase Sapphire Preferred® Card. Cardmembers earn 2x points per dollar on travel and at restaurants worldwide, plus 1x points on other purchases.

The signup bonus on this one is huge. Customers receive a 50,000 point signup bonus that is worth $625 toward your next trip.

This card also boasts extremely flexible rewards redemption. Card members can transfer Chase points to leading airline and hotel loyalty programs, like Marriott and United.

For that reason, the Chase Sapphire Preferred Card, rather than a more specific airline or hotel card, is the best fit for most people that have more general travel needs.

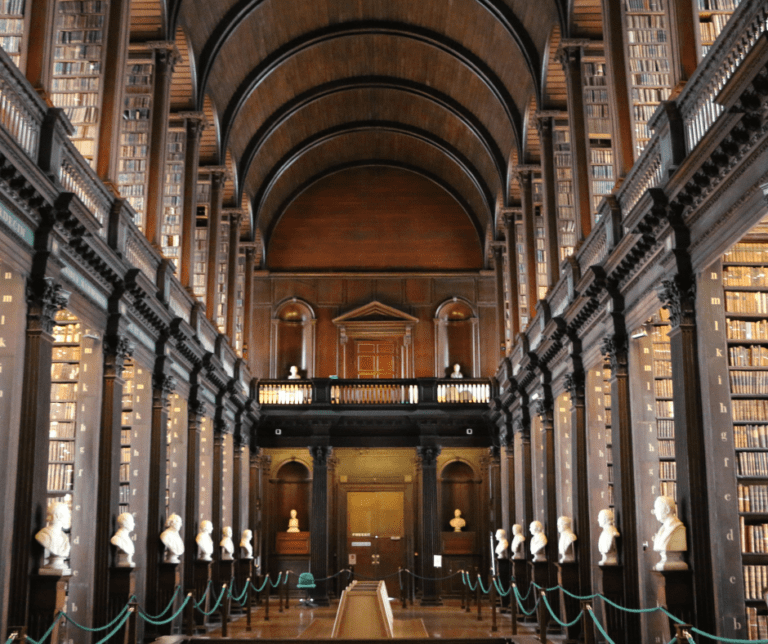

Planning a Trip to Europe?

We can help create your perfect itinerary!

- Worried you'll miss the hidden gems?

- How long should you stay in each place?

- Should you rent a car, train it, or both?

3. Alaska Airlines Visa Signature Credit Card

Alaska Airlines Visa is a great choice for a starter travel rewards card as it has a diverse roster of partners and a higher earning rate. Travelers earn 3 miles for every $1 spent directly on Alaska Airlines and Virgin America purchases and 1 mile for every $1 spent on all other purchases.

Get 30,000 bonus miles after you make $1,000 or more in purchases within the first 90 days of your account opening.

4. Hyatt Hotel Card

You’ll get a ton of value right off the bat with the Hyatt Credit Card with their killer sign-up bonus. Two free nights at any Hyatt in the world after you make $2,000 in purchases on the card in the first three months, plus an additional 5,000 bonus points for adding an authorized user on the card.

Hyatt has some fantastic high-end properties around the world where you can get some great use out of your points. The card gets 2x points at restaurants, car rental agencies and on tickets booked directly with airlines. However, just like this direct airline cards these cards are best used by travelers that know they will stay frequently at these hotels.

5. Southwest Rapid Rewards Plus Credit Card

If your main interest is simplicity and economy-class travel then the Southwest Rapid Rewards Plus card if for you.

Not only will you get a sign-up bonus of 40,000 points after spending $1,000 in the first three months, but since Southwest never has change fees, you can also book and re-book award travel repeatedly until you find the award price you want. While most of the main cards do not carry a foreign transaction fee, this card does have a 3% foreign transaction fee.

6. Capital One Venture Rewards Credit Card

Capital One Venture Rewards card is another great choice for travelers that earns flexible miles that can be redeemed against any travel purchase you make with the card.

The card earns 2 miles per dollar on all purchases, and customers receive a 40,000-mile sign-up bonus after you spend $3,000 on purchases in the first three months.

There are no foreign transactions fees, and as an added bonus, Capital One is now offering new cardholders a special metal card with a stainless-steel veneer instead of the usual plastic, so this is a card that will look good coming in and out of your wallet.

7. Barclaycard Arrival Plus World MasterCard

Barclaycard Arrival Plus World MasterCard is similar to the Capital One card above, with a slightly higher miles bonus upon redemption. Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 90 days and 2x miles on ALL purchases.

Customers can redeem points for travel with one of their many partners, cash back statement credits, gift cards or merchandise.

The Ultimate Pre-Travel Checklist

Download ‘10 Crucial Things To Do Before Traveling Abroad’ to avoid mistakes and ensure a smooth trip; adapters and electronics, packing tips, foreign currency, phone plans, and more!